Blockchain: Have we reached the mania stage?

Judging by some of the gems that have soared over the last few weeks, we may be in the mania stage of Bitcoin/Blockchain. While there may be merit to blockchain technology, the recent performance of following companies seems to indicate that irrationality seems to have overtaken the market.

FTFT Future Fintech Group Inc, which until last week was known as Sky Peoples Fruit Juice or SPU, a China-based beverage company, jumped 150% on a name change. It is a self-described “financial technology company and integrated producer of fruit-related products” (taken from website).

On December 21st, it issued a press release stating that” it had contracted REIT Technology company (Beijing) for $2million dollars to build a blockchain system (70% of which would be paid with its common stock)”. What would qualify REIT Technology Company for this task? Here are their “achievements” (taken from their website).

Seriously!? They contracted a company that makes walls and driveways from pavements stones to develop their blockchain? Maybe I am missing something?!?!?

This is a paragraph taken from the press release:

When operational, the Company believes GlobalKey Supply Chain will be able to utilize the newly developed blockchain system to undertake marketing for its core fruit juice business, food business and agricultural products business as well as to explore both marketing and supply chain management for other products. Also, as previously announced, GlobalKey Supply Chain signed a license agreement with Shaanxi Entai-Biotechnology Co. Ltd. to serve as the sole global general distributor and operational platform for ‘IB-LIVE’, a new generation of nutritious and healthy products for improving male sexual health. The Company believes the development of blockchain technology will be a key factor to its being able to execute marketing, sales and distribution and to integrate e-commerce and online direct selling programs.

For a company that is supposedly going to benefit from blockchain technology, they were not even able to update their website front page and replace the Juice Bottle pictures with something more relevant to blockchain. Here is a screenshot of their website on December 22nd:

LTEA Long Island Iced Tea, also a beverage maker, announced on December 21st that it was rebranding itself as Long Blockchain Corp. It rallied 300%, with it’s market cap increasing from 23 million to 92 million. This on the basis of the press release stating “it was in the preliminary stages of evaluating specific opportunities to grow the blockchain business”. This is the front page of their website:

Notice, they have tried to ride the gluten free and non-gmo trend as well, but isn’t all iced tea gluten free naturally?

Here is an excerpt from their press release:

The Company is already in the preliminary stages of evaluating specific opportunities involving blockchain technology. The discussions are only in the preliminary stages but indicate the areas of focus for the Company. These opportunities include potential partnerships, investments or acquisitions involving:

- A blockchain software developer building blockchain infrastructure for the financial services industry

- A London-based FCA regulated, institutional provider of FX services that is building multiple blockchain and digital crypto currency technology solutions for global financial markets

- A new smart contract platform for building decentralized applications that provides scalability beyond currently available options

However, the Company does not have an agreement with any of these entities for a transaction and there is no assurance that a definitive agreement with these, or any other entity, will be entered into or ultimately consummated.

Notice, they have no definitive plan or strategy, they just changed their name and mentioned the keyword blockchain.

RIOT, Riot Blockchain, a life sciences tools company otherwise known as Bioptix changed its name to Riot Blockchain and soared 400%. This is the third incarnation of RIOT, the first being APPY (a failed biotech) and then BIOP (another failure of a biotech). How is RIOT involved in blockchain? Besides changing its name, It paid $12.9 milllion for a two week old cryptomining company (Kairos Global Technolgy) that owned only $1.9million in assets.

RIOT’s daily chart says a thousand words:

Finally, there is LongFin Financial

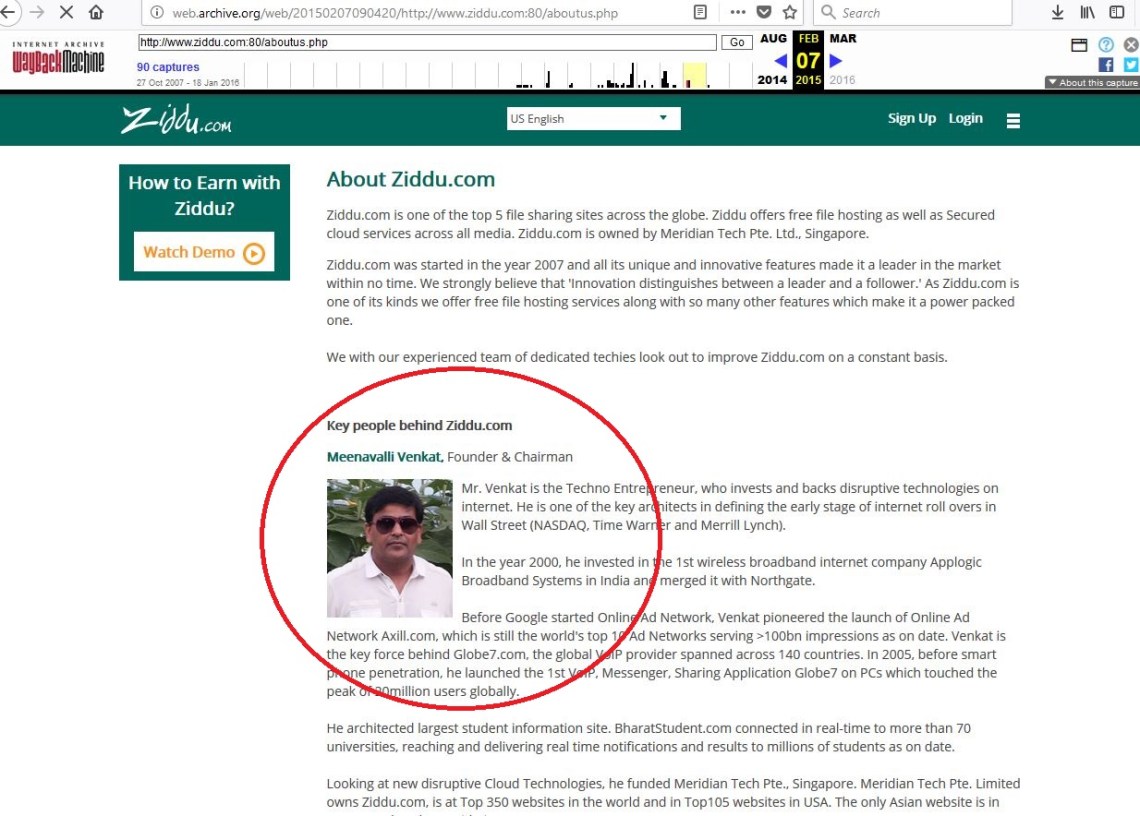

LFIN LongFin Financial, is a “global fintech company providing hedging and foreign exchange solutions to importers, exporters, and small and medium businesses. On Monday, it announced that it purchased Ziddu.com, a “blockchain technology provider” that offers microfinance lending. Considering it is a blockchain company, the Ziddu.com website is not even secure. The stock went from 5 on the Thursday the announcement to a high of 142.87 on Monday after the announcement, a gain of 2,600%. The ceo was on CNBC and did not inspire confidence in his interview, saying basically he had not good reason to justify why it was valued at 4 billion dollars. This, for a company has that has $40 million in revenues (according to their website). The biggest inconsistency is that LFIN and Ziddu.com have the same CEO. So the LFIN bought a company that their CEO was the founder, CEO and primary owner of.

Ziddu.com Website:

Longfin Financial Website:

Like during the .com bubble, these speculative stocks will soar and some people will make money, but these are not quality companies with solid fundamentals, and when the mania ends, and the stocks come crashing down, many retail/amateur traders will be crushed. If you do decide to trade them, please keep your bets small and use stoplosses!