Twitter Needs a Corporate Raider

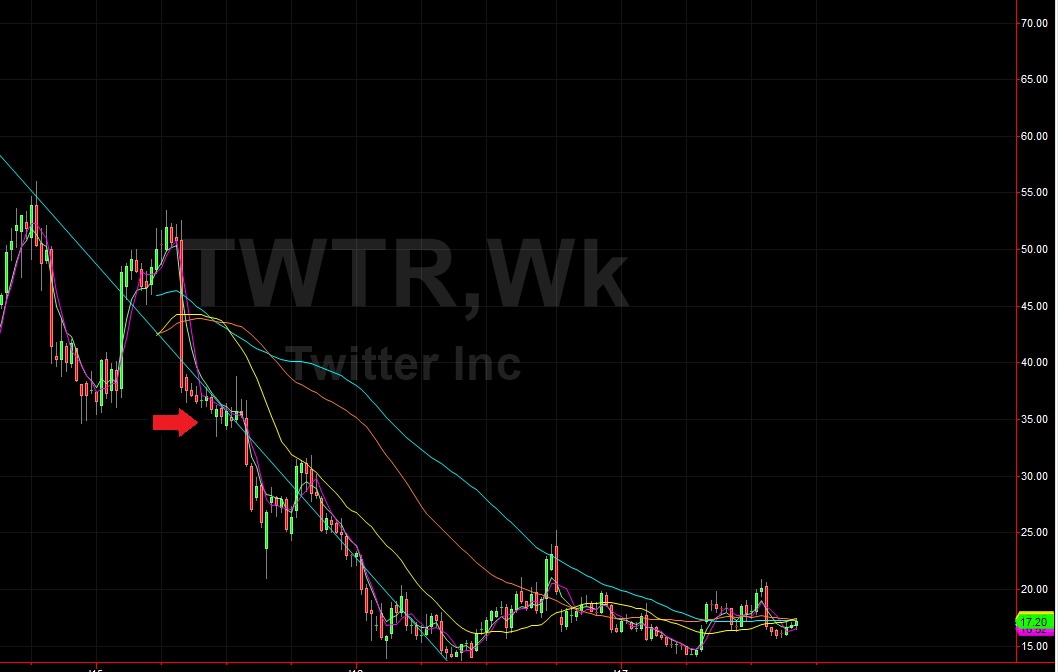

Twitter is a social media company whose enterprise value is significantly below its potential value. It has languished for the past few years under a CEO/founder who, although talented and visionary, is spread too thin as he is running two growth companies (Jack Dorsey is CEO of Twitter and Square). Since Jack took over again in July of 2015, user growth has effectively been stagnant (316m in 2015 vs 328m in 2017). Quarterly revenues have increased only modestly, from $502m to $574m, or 14% over two years. The stock price has declined from $35 a share to $17, a loss of approximately $12b.

Value Proposition:

Twitter is the de facto source for timely news and information. World leaders, sports stars, celebrities and experts in virtually every realm communicate important information through Twitter. Twitter has name brand recognition. Traditional mediums use information generated on Twitter for their news sources. Users of Twitter are generally loyal to the product and consider it far superior to other social media platforms.

Enterprise value per user:

Twitter’s users are valuable. They are intelligent, wealthy and a captive audience. None the less, they are valued at $26 per monthly average user. Compare that to LinkedIn, which was bought out at $249 per mau, Facebook, valued at $227 and even SNAP, which has a $71 value per user. Twitter generates $7 annual average revenue per user, but that could be easily increased with proper management.

Gross Margins:

Twitter has gross margins of 60-70%. Its operating margin is negative due to stock based comp, but it generates approximated $400m annually in cash flow.

Plan of Action:

Cost cutting:

Stock based compensation accounts for 20% of sales. I am fully appreciative of the benefits of stock based compensation, including the value of linking employee pay with company (hence stock) performance, but the level of stock comp is out of line with the value the employees are contributing. Research and development is taking $65-70m a quarter in stock comp without producing useful features or products.

Stock compensation needs to be brought more inline with performance. Now is the perfect time to realign the interests of the company, shareholders and employees. Since the stock price is low, the stock comp can be readjusted.

User and ARPU growth:

Twitter has been showing flat user growth and ARPU growth. Properly managed, the company should be able to grow at a 10-20% pace. Some ideas include: Embedding ads in Tweetdeck and partnering with ad agencies to create twitter ad content.

Artificial Intelligence:

Twitter has amazing real-time data. If Twitter can figure out an algorithm for search, it could be more valuable than a google search as its information is real-time, not delayed like Google. AI and data mining are hot businesses right now and Twitter is a prime candidate to take advantage of this trend.

Corporate Culture:

By many accounts, Twitter is suffering from internal politics, and backstabbing (See Nick Bilton’s Vanity Fair article). It needs an inspirational figure to steady the ship and ignite a positive work culture.

Trolling:

Twitter has improved its monitoring of fake accounts, but needs to make further progress. In addition, it needs to address trolling and abuse which causes frustrates its valuable users.

Opportunity:

In summary, Twitter is in limbo between a startup and a mature company. It has a lot of potential, but it needs to execute like the multi billion dollar company it is. If it is able to combine revenue growth with cost containment, it’s value could grow exponentially. On the other hand, if nothing is done, the stock price could keep falling.